In the fast-paced world of finance, quantitative trading tools have changed how we analyze and act on the market. These algorithmic trading platforms offer deep insights and powerful computing for market analysis.

These tools use advanced algorithms and data handling to help investors make better choices. Professional traders use these systems to spot opportunities, cut down risks, and fine-tune their strategies with great accuracy.

The world of quantitative trading tools keeps getting better, with new tech like machine learning and AI. Now, traders have access to platforms that give them detailed market info and strategic edges.

Key Takeaways

- Quantitative trading tools revolutionize market analysis and strategy development

- Advanced algorithms enable more precise investment decision-making

- Modern platforms integrate AI and machine learning technologies

- Real-time data processing enhances trading performance

- Sophisticated tools help minimize investment risks

Understanding Modern Quantitative Trading Tools

The financial markets have changed a lot with new quantitative trading tools. These tools have changed how traders look at, predict, and act on investment strategies.

Quantitative trading tools use complex math and computers to analyze markets. Traders use top-notch backtesting software to check their strategies with great detail.

Evolution of Trading Technology

The history of quantitative trading tools is marked by key steps:

- Early spreadsheet-based analysis

- Introduction of statistical modeling techniques

- Advanced algorithmic trading platforms

- AI-driven predictive analytics

Core Components of Quant Trading Systems

Today’s quantitative trading systems have many advanced parts:

- Data Collection Engines: Gathering market data from many places

- Advanced Analytics Modules

- Automated Execution Frameworks

- Real-time Risk Management Tools

Current Market Demands and Solutions

The financial world needs fast, precise, and flexible trading solutions. Quantitative trading tools now offer:

- High-speed processing

- Machine learning-enhanced predictions

- Seamless platform integrations

- Comprehensive risk assessment mechanisms

Traders and financial firms keep investing in advanced backtesting software. This software simulates complex market scenarios with high accuracy, pushing the limits of quantitative trading strategies.

Essential Features of Professional Trading Platforms

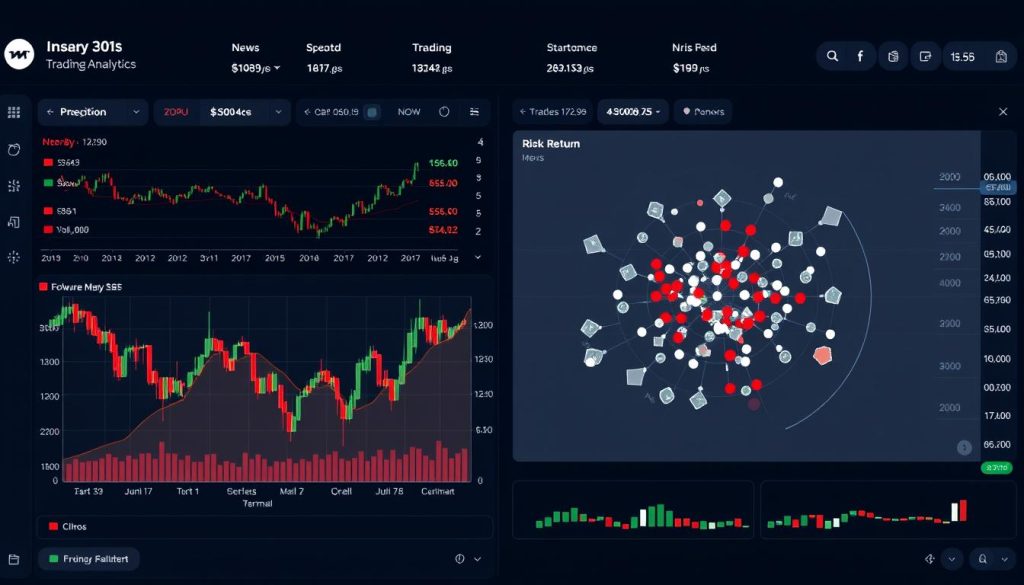

Professional algorithmic trading platforms have changed how we approach financial markets. They give traders advanced tools to analyze markets, make trades, and improve investment portfolios. This is done with great accuracy.

Top features of these platforms include:

- Advanced data visualization capabilities

- Real-time market data integration

- Customizable trading algorithms

- Risk management modules

- Portfolio optimization tools

Traders look for platforms that are easy to use but also offer complex analysis. Modern tools help investors:

- Understand investment risks

- Create strategic trading plans

- Automate trading

- Track performance

| Platform Feature | Performance Impact |

|---|---|

| Machine Learning Algorithms | Enhanced Predictive Analysis |

| Multi-Asset Support | Diverse Investment Strategies |

| Cloud Integration | Scalable Computing Power |

Choosing the right algorithmic trading platform can greatly boost investment results and efficiency for both individual traders and big investors.

Leading Algorithmic Trading Software Solutions

Exploring algorithmic trading platforms is complex. Traders and financial experts look for software that makes their strategies better and boosts market performance.

Today’s algorithmic trading platforms have many features for investors. They help manage risks and make trading more efficient.

Open-Source vs. Commercial Platforms

Choosing between open-source and commercial platforms is a big decision. Each has its own benefits:

- Open-Source Platforms:

- Lower initial cost

- Flexible customization

- Community-driven development

- Commercial Platforms:

- Dedicated technical support

- Advanced risk management systems

- Regular professional updates

Platform Selection Criteria

When picking a platform, consider these factors:

- Trading strategy complexity

- Budget constraints

- Required technical support

- Scalability potential

Integration Capabilities

Good integration is key for modern platforms. Traders should look at how well a platform connects with:

- Data providers

- Brokerage services

- Financial market databases

- Real-time market feed systems

The best platform offers strong performance, good risk management, and easy integration.

Data Analysis and Visualization Tools

Quantitative traders use advanced tools to turn complex data into useful insights. These tools help them understand financial patterns and make smart trading decisions.

Today’s visualization platforms offer many ways to understand market trends. They have features like:

- Real-time data streaming

- Interactive charts

- Multi-dimensional data display

- Advanced statistical tools

Traders use special software to make market data easy to see. This software helps them quickly understand financial trends through:

- Heat maps

- Candlestick charts

- Dynamic trend indicators

- Correlation matrices

“Data visualization is not about creating pretty pictures, but about communicating critical market insights with clarity and precision.” – Financial Technology Expert

Good trading signal generators work well with these tools. They give traders easy-to-use interfaces that show how to turn numbers into opportunities.

| Tool Category | Primary Function | Key Advantage |

|---|---|---|

| Time Series Analyzers | Pattern Recognition | Predictive Trend Mapping |

| Statistical Visualization Platforms | Data Interpretation | Complex Relationship Mapping |

| Real-Time Dashboards | Market Monitoring | Instant Decision Support |

Cutting-edge visualization tools represent the intersection of technology and financial strategy, empowering traders to make informed decisions with unprecedented speed and accuracy.

Machine Learning Applications in Trading

The financial world is changing fast with new machine learning trading models. These models are changing how we invest. Now, traders and analysts use smart algorithms to find important insights in big data.

Trading signal generators are key for investors wanting to stay ahead in fast-changing markets. These smart tools quickly scan through huge amounts of data. They find trading chances that people might miss.

Predictive Analytics Tools

Predictive analytics in trading use advanced algorithms to guess market moves. They can do things like:

- Real-time trend prediction

- Risk assessment modeling

- Market sentiment analysis

- Price movement forecasting

Pattern Recognition Software

Modern pattern recognition tech helps traders spot small market signals. Machine learning algorithms find complex patterns in different assets. This gives traders deeper insights into the market.

AI-Driven Decision Support

AI-powered decision support systems change trading strategies. They offer:

- Automated trade recommendations

- Rapid data processing

- Continuous learning mechanisms

- Reduced human emotional bias

Machine learning is not just a technological advancement, but a paradigm shift in how we understand and interact with financial markets.

Backtesting and Strategy Development Platforms

Quantitative traders use backtesting software to check and improve their trading plans. These tools mimic market conditions with historical data. This lets traders test their strategies and see how they might perform.

Advanced backtesting platforms have important features:

- Comprehensive historical market data integration

- Realistic transaction cost modeling

- Advanced statistical performance metrics

- Multi-asset strategy evaluation

- Risk management scenario analysis

Choosing the right backtesting software is key for traders. They need to look at data accuracy, how fast it works, and how flexible it is. These factors help in picking the best portfolio optimization tools.

| Platform | Data Coverage | Performance Analysis | Cost |

|---|---|---|---|

| MetaTrader | Forex, Stocks | Advanced | Free/Paid |

| QuantConnect | Multi-Asset | Comprehensive | Open Source |

| TradeStation | Equities, Options | Detailed | Subscription |

Professional traders know that thorough backtesting is essential. It helps create strong trading strategies that can handle real market challenges.

Real-Time Market Data Processing Tools

Quantitative trading needs advanced tools to stay ahead in financial markets. It’s all about processing market data fast and accurately. This is key to success in trading today.

Traders use top-notch tech to turn raw data into useful insights. The big challenge is handling lots of data quickly and precisely.

Data Feed Integration Strategies

Getting market data right away is crucial. Here’s what’s important:

- Real-time data streaming

- Combining data from many sources

- Strong filtering

- Fast data standardization

Market Data Provider Comparison

| Provider | Coverage | Latency | Cost Efficiency |

|---|---|---|---|

| Bloomberg Terminal | Global Markets | Low | High |

| Reuters Eikon | Comprehensive | Medium | Medium |

| Alpha Vantage | API-Based | High | Low |

Latency Optimization Techniques

Speed is everything for trading algorithms. Traders use advanced methods like:

- Hardware acceleration

- In-memory computing

- Parallel processing

- Network optimization

By combining the latest market data feeds with smart algorithms, traders can make better, faster trades.

Risk Management and Portfolio Analysis Software

Quantitative traders use advanced risk management systems to tackle complex financial markets. These tools give them key insights for making smart decisions and safeguarding their strategies.

Modern risk management software has many important features:

- Real-time market risk evaluation

- Advanced volatility tracking

- Comprehensive portfolio stress testing

- Automated risk threshold alerts

Portfolio optimization tools are great at analyzing different scenarios and forecasting financial outcomes. Predictive analytics turn market data into useful information. This helps traders predict market changes more accurately.

“Risk management is not about eliminating risk, but understanding and controlling it strategically.” – Professional Quantitative Trading Expert

Effective risk management systems have several key parts:

- Dynamic risk calculation algorithms

- Multi-dimensional portfolio analysis

- Integration with trading platforms

- Machine learning-enhanced predictive models

Professional traders know that strong risk management systems are crucial. By using advanced portfolio optimization tools, investors can create stronger trading strategies. These strategies balance potential gains with calculated risks.

High-Frequency Trading Infrastructure

High-frequency trading (HFT) is at the top of modern finance. It uses advanced engines and algorithms for fast market actions. The setup behind these systems is complex and well-made to grab tiny trading benefits.

Critical Hardware Requirements

For HFT success, top-notch hardware is key. Traders use special gear to handle data quickly. Important parts include:

- High-performance multicore processors

- Low-latency network interfaces

- Custom-built computational systems

- Redundant power and cooling mechanisms

Network Optimization Strategies

In HFT, network speed is crucial. Cutting down network latency can lead to winning trades. Traders use smart methods like:

- Direct market access protocols

- Fiber-optic communication lines

- Sophisticated routing algorithms

Colocation Services

Proximity is power in HFT. Colocation services put servers close to exchange data centers. This cuts down signal time, helping traders beat rivals by milliseconds.

“In high-frequency trading, every microsecond counts.” – Financial Technology Expert

Programming Languages and Development Environments

Choosing the right programming language is key for making strong quantitative trading tools and platforms. Traders and developers need to pick the best programming environments. This helps in building efficient and growing trading systems.

Python is a top choice in quantitative trading. It’s great for making complex trading algorithms because of its flexibility and big libraries. Data scientists love Python for its simple syntax and strong scientific tools.

- Python: Ideal for data analysis and rapid prototyping

- C++: Optimal for high-frequency trading systems

- R: Strong statistical analysis capabilities

- Java: Enterprise-level trading platform development

Developers pick languages based on what they need for trading. High-frequency trading needs fast solutions, which C++ provides. More and more, trading tools use many languages to be more flexible.

“The right programming language can make the difference between a successful trading strategy and a costly mistake.” – Professional Quantitative Trader

Integrated development environments (IDEs) are vital for making algorithms better. Tools like PyCharm, Visual Studio, and RStudio help a lot. They offer great debugging and optimization tools for advanced trading platforms.

Today’s quantitative trading pros need to be quick to learn and use many programming languages. This keeps them ahead in the fast-changing world of financial tech.

Advanced Statistical Analysis Tools

Quantitative trading tools have changed how we analyze finance. They use complex statistical methods. Now, traders can turn raw data into smart trading moves.

Statistical libraries are key for strong risk management systems. They help traders do detailed math and data analysis. This makes their work more precise.

Core Statistical Libraries for Trading

- NumPy: Fundamental numerical computing library

- SciPy: Advanced scientific computing capabilities

- Pandas: Data manipulation and analysis framework

- StatsModels: Statistical modeling and econometrics

Performance Metrics Evaluation

Quantitative trading tools help traders check how well their strategies work. They use important metrics like:

- Sharpe Ratio

- Maximum Drawdown

- Win/Loss Ratio

- Annualized Return

Risk Assessment Strategies

Risk management systems use advanced stats to measure market risks. Probabilistic modeling and scenario testing help predict and reduce risks.

Advanced statistical analysis transforms complex market data into actionable trading intelligence.

By using top-notch statistical tools, quantitative traders can make their strategies stronger. This leads to better investment results.

Market Sentiment Analysis Platforms

Trading signal generators have changed how traders understand the market. Today’s platforms use advanced machine learning to find useful insights in big data. They turn messy data into clear, useful trading advice.

What makes these platforms special includes:

- Natural language processing algorithms

- Social media trend tracking

- News feed sentiment scoring

- Real-time emotional market mapping

Advanced proprietary trading platforms now use sentiment analysis to guess market moves. They look at financial news, social media, and company talks to understand market feelings. This helps traders see what’s really happening in the market.

Machine learning models make these platforms better over time. They get smarter from past data, making their predictions more accurate. This means traders can spot subtle market signals that others might miss.

The future of quantitative trading lies in understanding not just numerical data, but the human emotions driving market behavior.

These advanced platforms give traders a big advantage. They turn simple data into valuable market insights. This marks a big step forward in using data to make trading decisions.

Order Execution and Management Systems

Order execution and management systems (OEMS) are key for modern trading. They use advanced algorithms to make trading smoother across many markets.

Quantitative traders count on OEMS for better trading. They offer several important features:

- Intelligent trade routing across diverse market venues

- Real-time risk management systems analysis

- Comprehensive transaction cost tracking

- Regulatory compliance monitoring

Smart Order Routing Strategies

Smart order routing algorithms are crucial for efficient trades. They look at many exchanges and dark pools to find the best routes. This helps lower costs and market impact.

Transaction Cost Analysis

Today’s algorithms give detailed views of trading costs. Traders can see each transaction’s cost clearly. This helps find ways to save money.

Compliance Monitoring

Risk management systems in OEMS keep trading in line with rules. They watch trading closely, alerting to any issues. They also keep detailed records for checks.

“Effective order execution is not just about speed, but about intelligent, compliant, and cost-efficient trading strategies.” – Financial Technology Experts

Cloud-Based Trading Solutions

Cloud-based trading solutions have changed the game in quantitative finance. They offer flexibility for algorithmic trading platforms. Traders can now access advanced market data feeds without big upfront costs.

These platforms let financial experts scale their computing needs easily. This cuts down on costs and makes them more responsive to the market.

Services like Amazon Web Services and Microsoft Azure are key for trading tech. They support complex algorithms with top-notch security and fast data processing. The cloud’s flexible setup makes it easy to handle big data and analytics in real-time.

Security is a big deal in cloud trading. Top cloud providers use strong encryption and multi-factor authentication. They also follow strict compliance rules to keep financial data safe.

More and more, financial institutions see cloud tech as a valuable asset. It helps with remote work, better risk management, and efficient use of resources.

The future of trading will likely see more cloud tech. Machine learning, advanced risk models, and market analysis tools will keep improving. Traders who use these new platforms will have a big edge in the global markets.